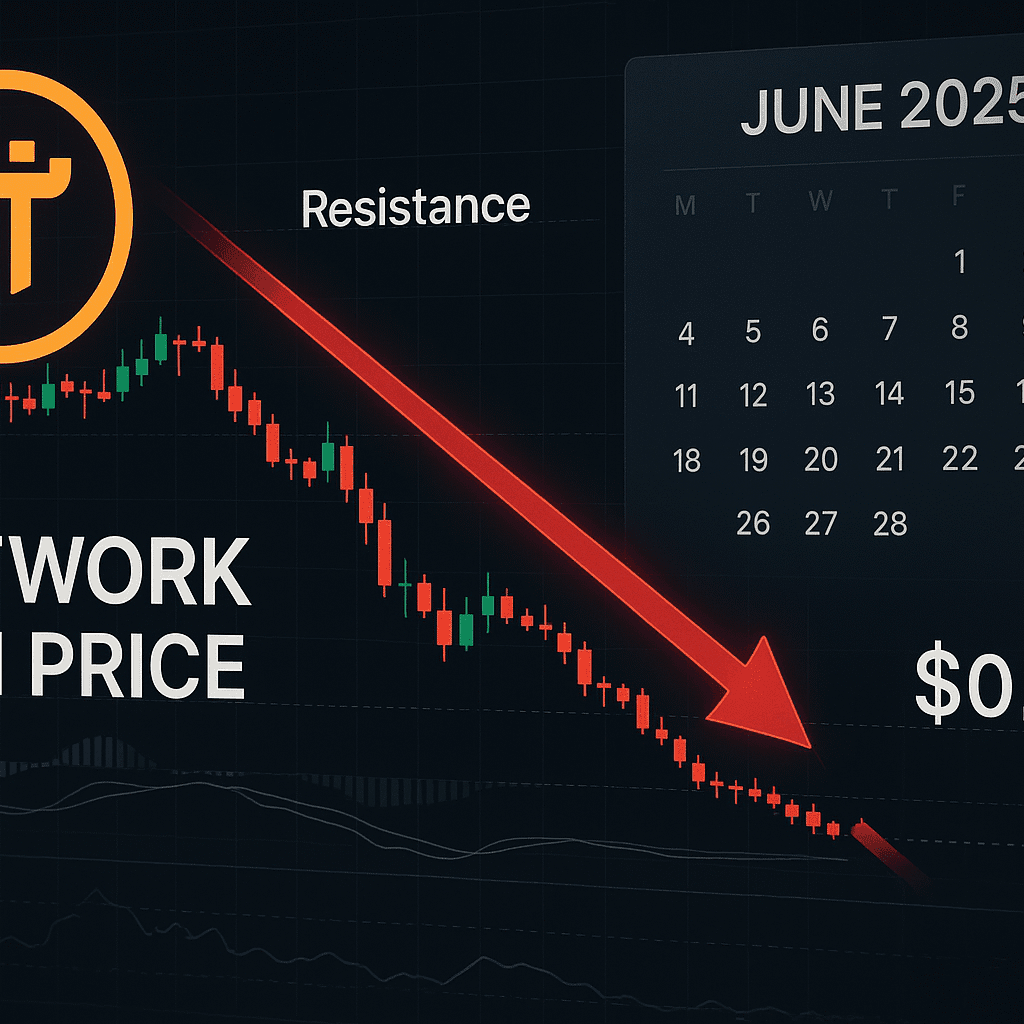

As June 2025 draws near, the Pi Network is facing intense bearish pressure, with the Pi Coin price slipping below crucial support levels and sparking concern among investors.

Currently trading around $0.68, Pi Coin has plunged more than 75% since peaking near $3 in February. The token remains stuck in a narrow consolidation zone between $0.688 and $0.816, signaling increasing indecision in the market and a noticeable lack of bullish momentum.

Technical Indicators Suggest Continued Weakness

From a technical perspective, the outlook remains pessimistic. Key moving averages—including the 10, 20, 50, and 100-day EMAs and SMAs—all hover above the current price, reinforcing bearish sentiment. The Relative Strength Index (RSI) is sitting at a neutral 43.6, while both the MACD and Chande Momentum Oscillator continue to indicate downward momentum. Meanwhile, Bollinger Bands are tightening, often a precursor to a significant price move—but for now, the trend remains clearly to the downside.

Token Unlocks & Exchange Activity Pose Major Risks

June could prove to be a decisive month for Pi Coin, with 263 million tokens set to be unlocked. This follows similar unlocks projected for July and August, which could further dilute the coin’s value and exert downward pressure on the market.

Rising inflows to exchanges suggest that more holders are preparing to sell, amplifying the risk of a sharp correction. According to InvestingCube, a break below $0.66 could send Pi tumbling toward $0.62, or even $0.59, unless bulls manage to reclaim the $0.7380 resistance level.

Crypto analyst Dr. Altcoin warned, “Without greater transparency from the Pi Core Team, Pi Coin could continue to drift lower through August.” However, he also hinted that a potential recovery may begin later this year—if sentiment improves or major network updates are introduced.

Can Pi Coin Bounce Back to $1?

Despite the short-term bearish trend, not everyone has lost hope. Some analysts believe that if buying interest picks up and market sentiment improves, Pi Coin could regain ground and approach the $1.00 to $1.20 range. With stronger momentum, it’s even possible that Pi could test $1.82 by the end of June.

Earlier this month, Pi Coin jumped nearly 10% when Bitcoin crossed the $110,000 mark, showing that Pi still reacts to broader crypto market movements.

Long-Term Vision: Ecosystem Growth May Hold the Key

In an effort to strengthen its real-world utility, Pi Network recently announced a $100 million Ventures Fund. This initiative aims to support the development of decentralized applications in fintech, e-commerce, gaming, and AI—sectors that could provide long-term value to the network.

However, critics point out that the project’s overall growth has been sluggish. Major exchanges like Binance and Bybit still haven’t listed Pi Coin, largely due to ongoing concerns around decentralization and the maturity of the ecosystem.

Additionally, many investors remain cautious due to uncertainty surrounding the mainnet launch and lack of governance clarity, which has dampened enthusiasm and kept trading volumes in check.

Read Also: Pi Network Mainnet Launch in India

Key Levels to Watch as June Unfolds

For bullish traders, reclaiming the $0.7380 resistance level is crucial. A breakout here could pave the way for further upside toward $0.76 and possibly the 0.786 Fibonacci level at $0.7586. On the downside, failure to hold above $0.688 could open the doors for a retest of the $0.60 level—or worse.

At press time, Pi Coin was trading at approximately $0.68, down 3.73% over the past 24 hours, according to Brave New Coin. Technical indicators continue to flash red, with RSI values on most timeframes still below 50, and MACD trends confirming weak buying interest.

Outlook: Will June Be a Make-or-Break Moment?

As June 2025 kicks off, the Pi Network sits at a crossroads. While a reversal is possible, the current combination of technical weakness, token unlocks, and investor caution suggests that bearish momentum may continue in the near term.

Looking ahead, the Pi Coin’s long-term success will likely depend on greater transparency from the core team, mainnet rollout clarity, and broader adoption, including listings on major exchanges.

With all eyes on what’s next, June could truly be a turning point—either a launchpad for recovery or the beginning of deeper losses—for the Pi Network.