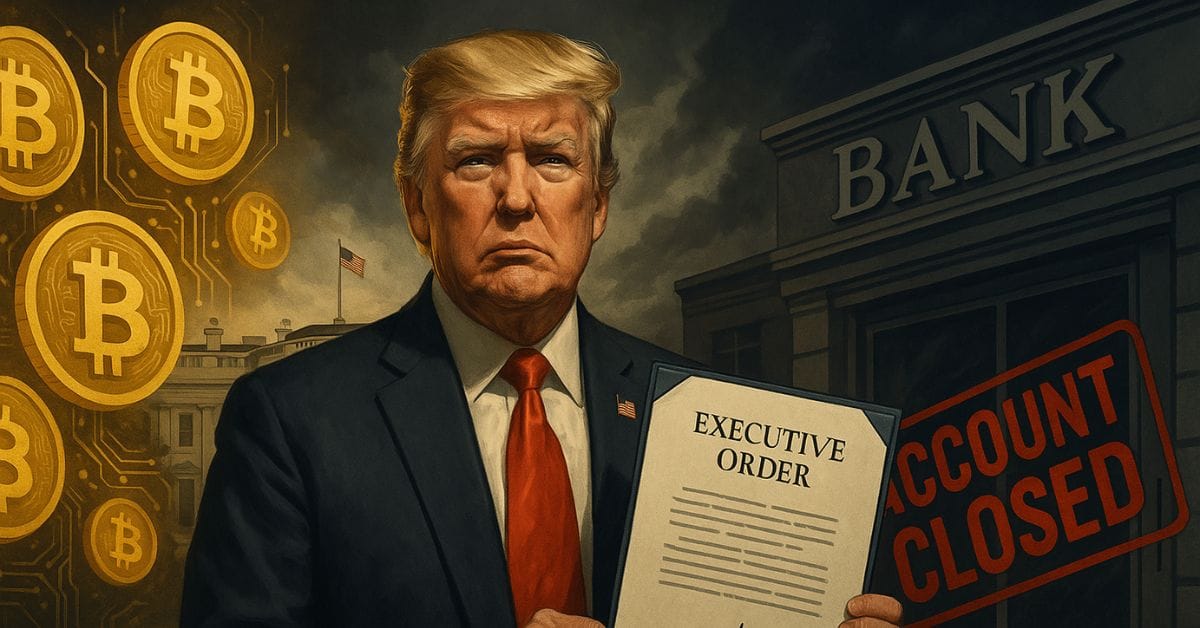

Former U.S. President Donald Trump is set to issue an executive order this week calling on federal regulators to investigate claims of “debanking” — a practice where financial institutions allegedly cut off access to services for cryptocurrency companies and politically conservative individuals or groups.

According to The Wall Street Journal, this upcoming directive will ask agencies to determine whether banks violated any antitrust regulations, consumer rights protections, or fair lending standards when they severed ties with certain clients. Financial institutions found guilty could face penalties or legal repercussions.

The order also instructs the Small Business Administration (SBA) to assess its loan guarantee procedures, with potential violations referred to the Department of Justice.

Cracking Down on “Operation Choke Point 2.0

This move follows persistent complaints from crypto industry leaders, who argue that the Biden administration pressured banks to distance themselves from digital asset firms — particularly after the high-profile collapse of crypto exchange FTX in 2022.

The term “Operation Choke Point 2.0,” popularized by crypto investor Nic Carter, describes what some see as a behind-the-scenes effort to disconnect cryptocurrency businesses from traditional banking services. A Freedom of Information Act (FOIA) case backed by Coinbase revealed that the Federal Deposit Insurance Corporation (FDIC) had advised certain banks to suspend crypto-related activities.

Allegations of Political Discrimination in Banking

Trump’s executive order will also look into accusations that banks denied or closed accounts based on customers’ political views — mainly impacting conservatives and right-leaning organizations. Although the order does not cite specific banks, it points to concerns that some financial institutions collaborated with federal investigations following the January 6 Capitol incident.

While banks often justify such closures as part of “derisking” — a strategy to avoid clients who pose reputational or legal risks — federal regulators are shifting their stance. In June, the Federal Reserve announced it would no longer include reputational risk in its assessments, aligning with recent decisions by the FDIC and the Office of the Comptroller of the Currency (OCC).

Reversing Internal Policies and Reassessing Lending Programs

Beyond directing investigations, the executive order is expected to push agencies to eliminate any internal policies that may have indirectly encouraged debanking. Additionally, the SBA will reevaluate its lending support framework to ensure small businesses — regardless of industry or political affiliation — are not unfairly denied financial backing.

This action could mark a pivotal shift in how U.S. banking handles digital assets and political bias, potentially setting new standards for transparency, fairness, and access across the financial system.