In the face of US sanctions, Afghans are turning to cryptocurrencies.

In the face of US sanctions, Afghans are turning to cryptocurrencies., Since the Taliban took control of Afghanistan,

US sanctions, failing banks, and the cessation of foreign aid and cash transfers have left the country’s economy in shambles. Crypto is on the way to save the day.

Farhan Hotak, a 22-year-old from Zabul province in southern Afghanistan, was left penniless after

the Taliban seized power in August of last year.

Mr. Hotak’s only source of income was a virtual wallet containing a few hundred dollars in Bitcoin.

Hotak was able to flee to Pakistan with his family of ten after converting it into a traditional currency.

“Crypto spread like wildfire across Afghanistan after the Taliban took over,”he said.

“There are almost no other options for receiving money.”

In the face of US sanctions, Afghans are turning to cryptocurrencies., Mr. Hotak and his friends use Binance’s peer-to-peer cryptocurrency exchange, which allows them to buy and sell coins directly with other Binance users.

Mr Hotak has taken up temporary residence in Pakistan, where he is trading Bitcoin and Ethereum once more.

He is now back in Afghanistan, vlogging and teaching people about cryptocurrencies, which are digital currencies with no physical form that can have value.

Cryptocurrency supporters claim that they are the future of money and that they will eliminate the need for people to rely on banks.

In Afghanistan, banks have shut down, forcing people to turn to cryptocurrency not only for trading but also for survival.

Web searches in Afghanistan for “bitcoin” and “crypto” increased in July, just before the takeover in Kabul,

according to Google trends data, as Afghans queued outside banks in vain attempts to withdraw cash.

What kind of humanitarian aid is being delivered to Afghanistan?

In the face of US sanctions, Afghans are turning to cryptocurrencies., The use of crypto increased dramatically after the Taliban took control in August 2021.

Last year, the data firm Chainalysis ranked Afghanistan 20th out of 154 countries in terms of cryptocurrency adoption.

Only a year prior, in 2020, the company deemed Afghanistan’s crypto presence to be so minor that it was left off the list entirely.

The country’s “crypto revolution” is a result of US sanctions against the Taliban and Haqqani group, according to Sanzar Kakar,

an Afghan American who founded HesabPay, an app that helps Afghans transfer money using cryptocurrency, in 2019.

Transactions with Afghan banks have all but ceased as a result of the sanctions.

The US has seized assets worth $7.1 billion (£5.4 billion) from the Afghan central bank and halted US currency transfers.

The printing of Afghan currency by companies in Poland and France has come to an end.

Swift, the Society for Worldwide Interbank Financial Telecommunication, which underpins international financial transactions, has halted all operations in Afghanistan.

Following the liquidity crisis, commercial banks were unable to lend money, and retail customers were unable to withdraw their own funds from banks.

Afghanistan’s economy, already ravaged by war and reliant on foreign aid and donors for 80% of its GDP, was on the verge of collapsing.

In the face of US sanctions, Afghans are turning to cryptocurrencies., “We’re using crypto to try to solve this problem,

” Mr Kakar said, referring to the fact that 22.8 million Afghans are on the verge of starvation, with one million children at risk of dying this winter.

Mr Kakar’s HesabPay app enables instant money transfers from one phone to another without involving banks,

the Afghan government, or the Taliban. The app had over 2.1 million transactions and 380,000 active users in its first three months.

In Afghanistan, aid organisations have recognised the potential of cryptocurrency.

Roya Mahboob founded Digital Citizen Fund, an NGO that teaches young Afghan women computer programming and financial literacy, in 2013.

In Herat and Kabul, the organisation had 11 women-only IT centres, where 16,000 women were taught everything from Windows software to robotics.

Following the Taliban’s takeover, the organisation refocused its efforts to provide cryptocurrency training to young women via Zoom video calls.

The Digital Citizen Fund has also begun sending money to Afghan families in the form of cryptocurrency to assist them in providing food and shelter, as well as, in some cases, assisting people in escaping the country.

“In the last six months, Afghanistan has relied heavily on cryptography. Everyone is talking about trading these days.

It got to the point where I was getting on a plane to Kabul and hearing people discussing Dogecoin and Bitcoin “Ms Mahboob told the BBC about her experience.

In the face of US sanctions, Afghans are turning to cryptocurrencies., Stablecoins, or virtual coins pegged to the US dollar, are gaining traction in Afghanistan, removing the volatility typically associated with cryptocurrency.

The recipients then use money exchanges to convert the stablecoins to local currency.

They can also be sent to recipients directly without requiring a bank account.

However, there are obstacles that make cryptocurrency more difficult to obtain for the average Afghan.

While internet access is increasing, it is still limited. According to DataReportal.com, there were 8.64 million internet users in Afghanistan in January 2021.

Power outages are a common occurrence, so unreliable electricity is a major issue.

And, with the banking system in shambles, many Afghans are unable to pay their electricity bills.

When it comes to cryptography, education is also crucial. Mr Hotak claims to have found trustworthy online communities on Telegram, WhatsApp, and Facebook that provide him with trading tips and sound advice.

However, there is a lot of misinformation about cryptocurrency on the internet.

However, cryptocurrencies are not a panacea, according to the expert. HesabPay’s senior advisor, Nigel Pont.

He believes that releasing the financial constraints imposed on Afghanistan is critical to alleviating the country’s growing poverty.

“Afghanistan is starving because of the traditional centralised fiat system’s failures.”

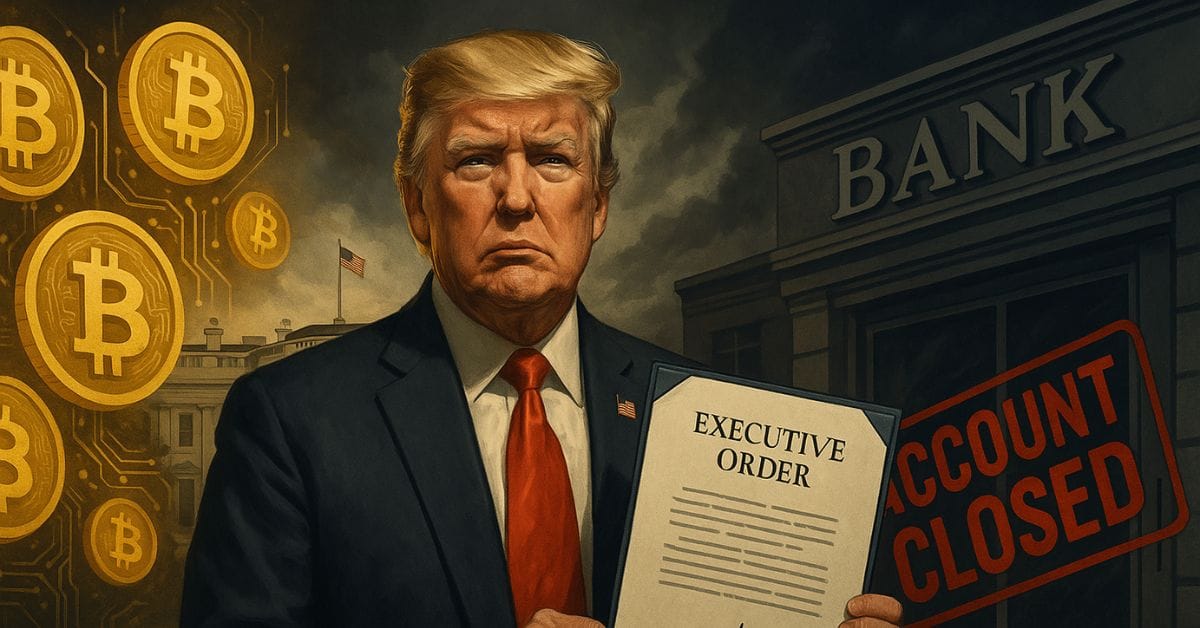

In February, US President Joe Biden signed an executive order dividing $7 billion in frozen Afghan funds between Afghan aid and US 9/11 victims, who sued the Taliban and al-Qaeda in 2010 for their roles in the attack.

Start Trade cryptocurrnency : CTSKOLA

Read More : rbcblogs