The ECASH Bill: A Digital Dollar in the Making, Money, as we know it now, might not exist in a few years.

Alternatives like Bitcoin are forcing governments to reconsider their current monetary system.

Members of the US House of Representatives, for example, pushed for a government-backed digital currency.

On Monday, Representative Stephen Lynch introduced the Electronic Cash and Secure Hardware (ECASH) bill, which received bipartisan support.

The bill requires Secretary of the Treasury Janet Yellen to test an electronic version of the US dollar known as the e-cash, among other things.

What exactly is E-Cash?

The ECASH Bill: A Digital Dollar in the Making, According to the proposed ECASH bill, the Treasury Department must create an Electronic Currency Innovation Program (ECIP).

ECIP’s goal is to test a series of pilot projects centred on a government-issued digital legal tender known as “e-cash.”

If the bill passes, the Treasury must start the pilot program within 90 days and make e-cash available to the public within four years.

the use of private intermediaries such as banks and credit card companies, which is a key feature that sets it apart from other digital currencies.

E-main cash’s goal is to protect its users’ privacy while also allowing them to operate without using the internet.

The ECASH bill also includes the following provisions:

The ECASH Bill: A Digital Dollar in the Making, A mechanism for coordination: If the bill is signed into law,

it will establish a Digital Dollar Council, which will be led by the Treasury Secretary and will coordinate with various government agencies, including the Federal Reserve.

Development and research: ECIP are in charge of developing the necessary infrastructure for electronic cash.

Hardware wallets, for example, are used to store e-cash in a secure manner.

Make privacy a top priority: The resulting Act will create an independent Monetary Privacy Board to ensure that e-cash users’ privacy and civil liberties are protected.

Account for funding: To fund the e-cash program, a bank account will be opened with the Federal Reserve.

The Board of Governors of the Federal Reserve will be in charge of liquidity.

What Is the Difference Between E-Cash and a CBDC?

The ECASH bill clearly draws a distinction between Central Bank Digital Currencies (CBDC) and the proposed digital dollar.

As a result, e-cash is not a CBDC in the strictest sense.

“The ECASH Act will complement and advance ongoing efforts by the Federal Reserve and President Biden.

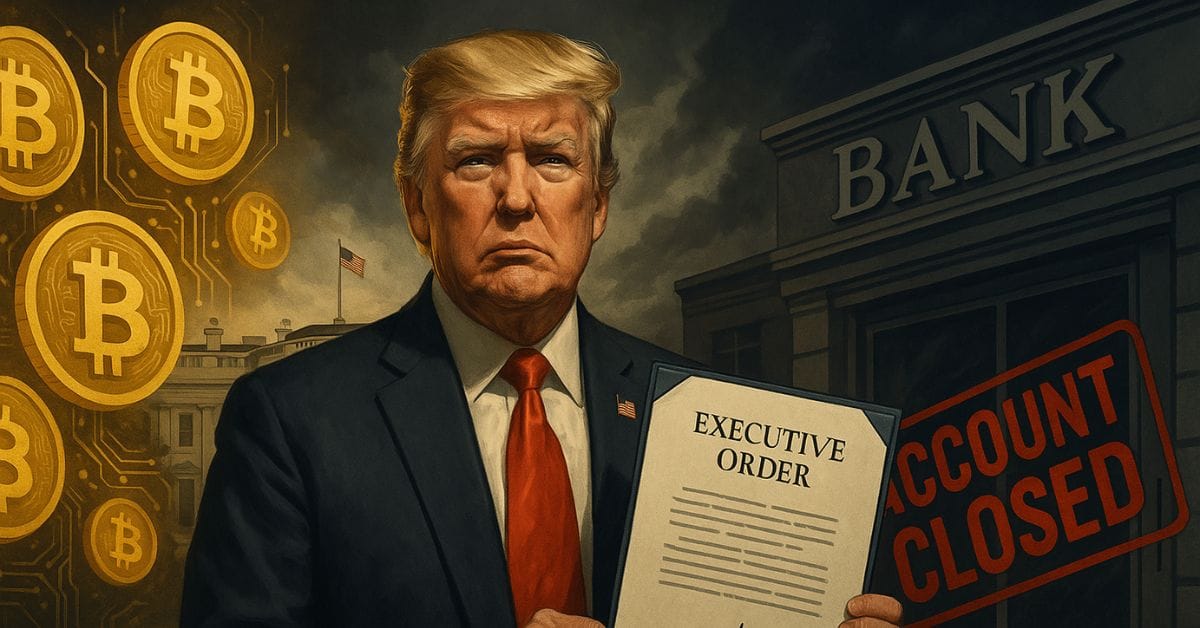

The ECASH Bill: A Digital Dollar in the Making, to examine potential design and deployment options for a digital dollar,” Stephen Lynch said, referring to President Biden’s

recent Executive Order on Cryptocurrencies, which includes CBDC research as a priority.

E-Advantages Cash’s

E-cash combines physical cash’s “privacy-protecting feature” with the advantages of digital currencies.

E-cash will have minimal transactional data-generating properties, according to Congressman Lynch, ensuring anonymity in peer-to-peer transactions.

Apart from data privacy and consumer protection, e-cash offers the following advantages:

Offline transactions secured by hardware devices enable fast and effortless transfer between people and businesses.

People without bank accounts will benefit from e-cash because it will give them better access to the monetary system.

More security, as banks may fail or face liquidity issues, e-cash issued by the US government is unlikely to do so.

What Should a Speculative Investor Know?

Janet Yellen, the US Treasury Secretary, has changed her mind about cryptocurrencies.

Yellen, who had previously been a vocal opponent of cryptocurrency, has now admitted that it has advantages.

“Crypto has obviously grown by leaps and bounds,

it’s now playing a significant role, not so much in transactions as in [many] Americans’ investment decisions,” she admitted.

Yellen isn’t the only one who thinks this way.

Nearly 90 countries, including India, are now experimenting with digital currencies in some form.

The introduction of the ECASH bill shows that digital currencies like CBDC are part of a larger trend.

E-cash, in particular, is a fascinating concept because it addresses CBDCs’ biggest flaw:

This trend, as well as other factors such as Russia’s intention to accept Bitcoin for oil and gas payments, have benefited the crypto market.

This week, the total crypto market capitalization surpassed $2 trillion for the first time.

Bitcoin, Ethereum, and other popular altcoins have all made significant gains in recent days.