Summary

Barring Polkadot, which declined up to 10 per cent, nine of the top 10 cryptocurrencies were trading at 9.30am Indian time. Solana lost 13 per cent, while Cardano lost over 6 per cent.

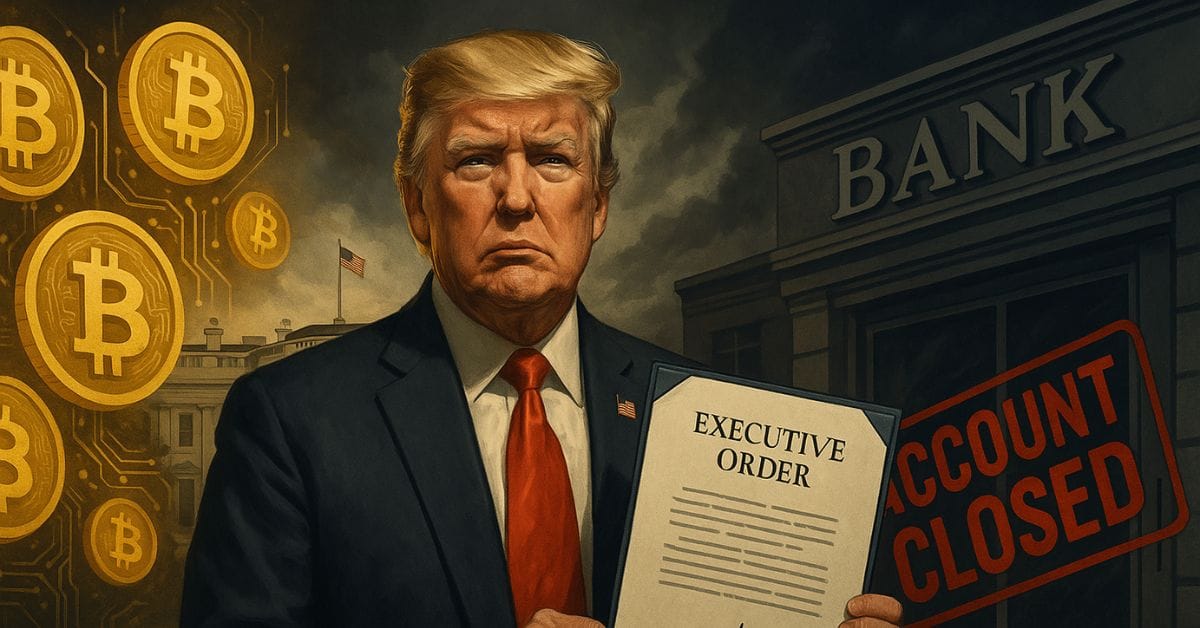

New Delhi: After a major decline, the leading cryptocurrency entered a consolidation phase at the start of the new week. Most cryptocurrencies have been battling deep scars since last week.

Barring Polkadot, which declined up to 10 per cent, nine of the top 10 cryptocurrencies were trading at 9.30am Indian time. Solana lost 13 per cent, while Cardano lost over 6 per cent.

The global crypto market cap fell more than one percent to $2.05 trillion over the previous day. However, the total crypto market volume is around $110.56 billion.

Sharan Nair, chief business officer at CoinSwitch Kuber, said, “If we look at the last week, the market saw a slight drop, but Polkadot did well.

Read Also: https://rbcblogs.com/cryptocurrency-mining/

Eminent economist and former RBI governor Raghuram Rajan has said that cryptocurrencies are a speculative asset right now, and it will remain so until developments and regulations are made.

To take advantage of the festive season that began with Ganesh Chaturthi on Friday, Indian crypto exchanges are planning to hire and launch products and run massive advertising campaigns to engage new retail investors.

The last 24 hours in the crypto spectrum were more of a consolidation phase. Mudrex CEO and co-founder Edul Patel said that both Bitcoin and Ether revolve around their support levels. Bears will be closely watching the $45,000 level in BTC. If it breaks, we can expect selling momentum.

“However, for some of the top altcoins, the last 24 hours had a good session. Polkadot and Chainlink made some decent moves due to the large volume driven,” he said.

US officials are discussing launching a formal review into whether Tether and other stablecoins threaten financial stability, an investigation that could lead to a dramatically ramped-up oversight for a fast-growing corner of the crypto market. can do.

Take View by Siddharth Menon, COO WazirX

The total crypto market cap recently touched $2.4 trillion since the uptrend in a possible ascending channel pattern from the third week of July.

Accordingly, we have observed a trend reversal over the past few days, which can be attributed to recent market volatility due to bitcoin adoption in El Salvador as well as a 2% drop in US markets. The recent correction has seen some high volume selling.

Meanwhile, bitcoin is trading below its 200-day moving average. BTC may continue to decline towards the $41,000 support level.

We could potentially see some panic selling in the near term. However, keeping an eye on the future long-term potential of the crypto market, a smart investor would HODL or want to see this as a buying opportunity.

Major level

Support: $2,950, $2,650

Resistance: $3,700, $4,000

(Time is in UTC and daily time range is 12:00 AM – 12:00 PM UTC)